Global Bond Rout Triggers Multi-Asset Selloff as Yields Hit Multi-Decade Highs | Links: [1], [2], [3], [4]

A synchronised global bond selloff sends shockwaves across financial markets, with US 30-year Treasury yields approaching 5% whilst UK 30-year gilt yields surge to their highest levels since 1998. Japanese long bonds also hit multi-decade highs as fiscal sustainability concerns intensify across major developed economies. The coordinated nature of the selloff suggests structural worries about debt burdens rather than isolated regional issues, with mounting concerns over persistent inflation expectations adding fuel to the fire. This bond market stress proves highly contagious - Asian stocks fall to three-week lows, European markets close near one-month lows, and US equities retreat as rising yields compress valuations across growth stocks and interest-rate sensitive sectors.

UK Fiscal Crisis Deepens as Gilt Yields Soar to 1998 Highs | Links: [5], [6], [7], [8]

UK government borrowing costs spike dramatically, with traders describing a "bruising day" for British assets as bond markets question Chancellor Rachel Reeves' fiscal credibility. The pound extends its slide amid growing investor scepticism about the government's ability to present a credible plan for public finances, with the delayed Budget now expected mid-November at the earliest. Leading bond market figures now urge Reeves to cut spending rather than raise taxes, arguing the current trajectory remains unsustainable. Market participants point to what they describe as a "chorus of high tax advocates in No 10" as contributing to the loss of confidence, with speculation mounting about potential targets including pensions and higher bank levies. Without credible fiscal consolidation, economists warn the UK faces a prolonged period of elevated borrowing costs that could undermine economic recovery.

Tech Sector Rebounds as Google Avoids Antitrust Breakup | Links: [9], [10], [11], [12]

Google shares surge 8% after a federal judge rules the search giant can avoid the worst-case penalties in its landmark antitrust case, including a potential company breakup. The ruling allows Google to maintain its Chrome browser and continue paying Apple for default search placement, providing crucial regulatory clarity that removes a significant overhang from the technology sector. Apple shares also rise 3% on confirmation it can keep receiving billions in payments from Google, whilst stock futures edge higher following the announcement. The decision represents a major victory for both companies and provides broader relief to the technology sector, which had been bracing for potentially severe regulatory intervention. The relatively lenient outcome reduces concerns about aggressive tech regulation that could have set precedents for other major platforms, particularly significant as technology companies face increasing scrutiny globally.

Gold Strikes Fresh Records as Haven Demand Accelerates | Links: [13], [14]

Gold extends its record-breaking run to fresh all-time highs as investors seek safe-haven assets amid global bond market turmoil and mounting geopolitical tensions. The precious metal's surge reflects broad-based concerns about currency debasement, inflation persistence, and systemic financial stability as central bank policies face increasing political interference worldwide. This rally comes as traditional portfolio diversification assumptions face challenges, with both bonds and equities selling off simultaneously - a scenario that historically drives investors toward alternative stores of value. The metal's appeal has intensified across Asian markets, which remained under pressure as gold benefits from both technical momentum and fundamental concerns about the stability of fiat currencies and sovereign debt sustainability across major economies.

Fed Independence Under Fire as Central Bank Authority Faces Political Pressure | Links: [15], [16], [17], [18]

Federal Reserve independence faces further attack as Trump intensifies efforts to influence monetary policy, with ECB President Lagarde warning this poses a "very serious danger" to the global economy. Over 600 economists rally to support Fed Governor Lisa Cook amid Trump's attempts to oust board members, whilst congressional hearings are set to assess the scope of political interference with central bank authority. The controversy extends beyond personnel, with Trump claiming stocks "want the tariffs" whilst Treasury markets signal growing concern about policy uncertainty. ECB officials express alarm about potential contagion effects on global monetary policy coordination, warning that politicisation of central banks could undermine independent monetary policy worldwide. This institutional conflict comes as central banks globally navigate complex inflation dynamics, with any erosion of credibility potentially destabilising financial markets and long-term economic stability.

| Dow Jones Industrial Average | --▲ +0.02% |

| S&P 500 | --▲ +0.22% |

| Hang Seng Index | --▼ -0.36% |

| FTSE 100 | --▼ -0.87% |

| CAC 40 | --▼ -0.99% |

| DAX 40 | --▼ -2.04% |

• US JOLTs Job Openings at 15:00 BST - Previous: 7.437M - Key labour market indicator that influences Fed policy decisions and provides insight into employment demand ahead of Friday's jobs report.

• EU ECB President Lagarde Speech at 08:30 BST - Central bank communication that could signal future monetary policy direction and impact EUR currency movements.

• UK BoE L Mann Speech at 08:30 BST - Bank of England policymaker remarks may provide clues on interest rate outlook following recent inflation data.

• US Fed Musalem Speech at 14:00 BST - Federal Reserve official commentary could influence market expectations for December rate decisions and 2025 policy path.

• Turkey Inflation Rate YoY at 08:00 BST - Previous: 33.52% - Critical data for emerging market sentiment as Turkey continues battling persistent high inflation.

• South Africa GDP Growth Rate YoY at 10:30 BST - Previous: 0.8% - Key emerging market economic indicator that could affect ZAR and broader EM risk appetite.

• Salesforce (CRM) During-Hours - Est: TBD vs Prev: $2.58 - Mega-cap cloud leader's guidance on AI adoption and enterprise spending could signal broader tech sector health

• Ashtead Group (ASHTF) During-Hours - Est: TBD vs Prev: $0.79 (+9.9% surprise) - Equipment rental giant's performance indicates construction and infrastructure investment trends across US and UK markets

• Hewlett Packard Enterprise (HPE) During-Hours - Est: TBD vs Prev: $0.38 (+9.7% surprise) - AI server demand and hybrid cloud growth momentum could drive enterprise hardware sector sentiment

• Dollar Tree (DLTR) During-Hours - Est: TBD vs Prev: $1.26 (+4.5% surprise) - Discount retailer's margins and consumer spending patterns will signal retail sector resilience amid economic uncertainty

• Credo Technology Group (CRDO) During-Hours - Est: TBD vs Prev: $0.35 (+27.8% surprise) - Semiconductor connectivity solutions provider's strong surprise rate suggests continued data center infrastructure demand

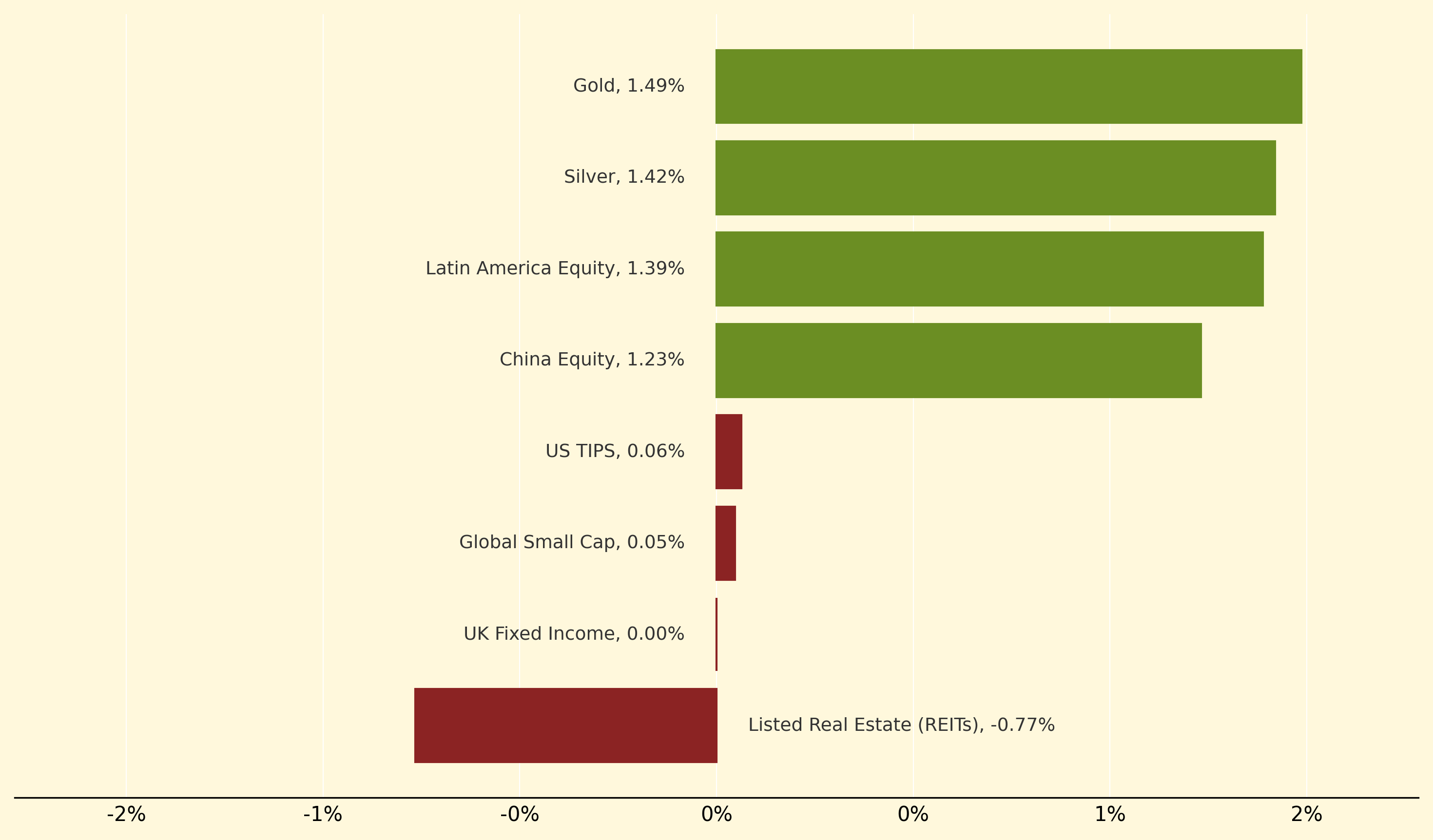

Precious metals dominated yesterday's winners, with Gold climbing 1.49% and Silver advancing 1.42% as investors sought safe-haven assets amid the global bond selloff that pushed Treasury and gilt yields to multi-decade highs. Latin America Equity also performed strongly at 1.39%, whilst China Equity gained 1.23% despite broader Asian market weakness, suggesting selective regional rotation as global fiscal concerns intensified.

Listed Real Estate (REITs) bore the brunt of yesterday's losses, falling 0.77% as rising bond yields compressed valuations across interest-rate sensitive sectors. The selloff's impact on income-focused strategies was evident, with UK Fixed Income flat at 0.0% and traditional balanced portfolios managing only modest 0.06% gains as the synchronised nature of the global bond rout undermined typical diversification benefits.

Duration risk: The sensitivity of bond prices to interest rate changes, measured as the percentage price decline per unit rise in yield, explaining why long-dated gilts and Treasuries are experiencing severe losses as yields hit multi-decade highs in the current global selloff.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry