Central Bank Policy Divergence Creates Complex Cross-Asset Dynamics | Links: [1], [2], [3]

Three major central banks delivered conflicting signals that left markets parsing mixed messages across currency and fixed income desks. The Fed's 25 basis point cut masked significant internal discord, with officials split on future policy direction and warnings that inflation risks becoming "entrenched." The wide dot plot dispersion and tepid market reaction reflects genuine uncertainty about the easing path ahead. Meanwhile, the Bank of Japan delivered a hawkish surprise by announcing plans to begin selling its massive ETF holdings while maintaining rates at 0.5%, with two members voting for immediate hikes. The Bank of England held rates at 4% but slowed quantitative tightening to £70 billion annually, deliberately concentrating on shorter-dated gilts to reduce market disruption. This three-way policy split creates significant cross-currency volatility as traders position for divergent monetary paths that could reshape global fixed income strategies.

Nvidia's $5 Billion Intel Investment Reshapes Semiconductor Landscape | Links: [4], [5], [6]

Intel surged 22.8% in its best day since 1987 after Nvidia announced a $5 billion strategic investment that fundamentally alters competitive dynamics in the global semiconductor sector. The partnership involves co-designing chips and represents a crucial lifeline for the struggling chipmaker while positioning Nvidia as both a major shareholder and strategic supplier across Intel's product ecosystem, though notably excludes Intel's foundry operations. Nvidia CEO Jensen Huang described it as "an incredible investment," emphasising strategic value beyond financial returns as both companies battle intensifying Chinese competition. The transaction carries significant geopolitical implications, arriving as China simultaneously restricts Nvidia's market access while investing heavily in domestic chip capabilities. This consolidation could pressure TSMC's foundry dominance and reshape supply chain dynamics away from Asian manufacturers, with implications reverberating through AMD, Qualcomm, and the broader technology ecosystem that has driven equity indices to consecutive records.

Historic French-Italian Bond Yield Convergence Signals European Credit Risk Shift | Links: [7]

French and Italian 10-year government borrowing costs have converged for the first time in history, marking a seismic shift in eurozone credit risk perception that challenges decades of core-periphery dynamics. The convergence reflects France's deteriorating fiscal position amid political uncertainty and budget concerns, while Italy has benefited from improved economic fundamentals and more stable governance under Giorgia Meloni's administration. This development forces European fixed income managers to reassess fundamental assumptions about sovereign risk premiums, potentially affecting ECB policy transmission mechanisms and the broader stability of European monetary union. Traditional safe-haven flows that once automatically favoured French OATs over Italian BTPs now face a dramatically altered risk landscape, with implications extending far beyond government bond markets into corporate credit and currency positioning strategies.

Trump Challenges Federal Reserve Independence Through Supreme Court Appeal | Links: [8]

Trump's unprecedented Supreme Court request to remove Fed Governor Lisa Cook represents the most direct assault on central bank independence in modern American history, with potentially profound implications for USD-denominated assets and global monetary policy credibility. This constitutional challenge strikes at the foundational principle separating monetary policy from political interference, timing that coincides with growing political pressure on the Fed following its dovish pivot amid persistent inflation concerns. The case could fundamentally alter the Fed's governance structure and reshape global perceptions of US institutional stability, extending far beyond domestic politics to affect international dollar reserves and policy frameworks worldwide. Market participants must now price in constitutional uncertainty alongside traditional monetary policy risks, as any Supreme Court ruling could establish precedent affecting central bank independence globally. The timing amplifies concerns about Fed policy effectiveness just as officials warn inflation risks becoming entrenched.

China's Strategic Trade Repositioning Sets Stage for Enhanced US-China Tensions | Links: [9], [10], [11]

China is abandoning US soybeans for the first time since the 1990s, building agricultural leverage ahead of the anticipated Trump-Xi phone call that could determine TikTok's fate and broader bilateral economic relations. This strategic pivot away from American agricultural imports reflects China's systematic effort to reduce supply chain dependence while constructing alternative sourcing networks across emerging markets. The timing coincides with Trump declining Taiwan military aid packages to prioritise trade negotiations, signalling his administration's economic-first approach to foreign policy. Treasury Secretary Bessent noted that China's yuan positioning at record lows against the euro while strengthening against the dollar creates "bigger problems for Europe than the US," highlighting complex triangular trade dynamics. With agricultural commodities facing restructured demand patterns and technology sectors bracing for renewed restrictions, these developments set the stage for intensified economic competition that will define market conditions throughout 2025.

| Dow Jones Industrial Average | --▲ +0.19% |

| S&P 500 | --▲ +0.08% |

| Hang Seng Index | --▼ -1.19% |

| FTSE 100 | --▲ +0.21% |

| CAC 40 | --▲ +0.41% |

| DAX 40 | --▲ +0.41% |

| Euro Stoxx 50 | --▲ +1.26% |

| Nasdaq Composite | --▲ +0.14% |

| Nasdaq-100 | --▲ +0.14% |

| Nikkei 225 | --▲ +0.87% |

| S&P/ASX 200 | --▼ -0.83% |

| Shanghai Composite | --▼ -1.15% |

| S&P 500 E-mini | 6697.25+3.75▲ +0.06% |

| Nasdaq-100 | 24716.00+10.50▲ +0.04% |

| FTSE 100 Index | 9290.00+1.50▲ +0.02% |

| EURO STOXX 50 | 5463.00-3.00▼ -0.05% |

| WTI Crude Oil | 63.11-0.15▼ -0.24% |

| Gold (COMEX) | 3692.00+13.70▲ +0.37% |

| Copper (COMEX) | 4.62+0.02▲ +0.34% |

| US 10-Year Treasury | 112.88-0.11▼ -0.10% |

| UK Long Gilt (10Y) | 117.82-0.02▼ -0.02% |

| German Bund (10Y) | 128.39-0.12▼ -0.09% |

| Italian BTP (10Y) | 119.96-0.38▼ -0.32% |

| US Dollar Index | 97.02+0.04▲ +0.05% |

| VIX Volatility | 17.65-0.02▼ -0.15% |

| SONIA 3M Interest Rate | 96.14+0.00▲ +0.01% |

• UK Retail Sales MoM at 07:00 BST - Forecast: 0.2% vs Previous: 0.6% - Sharp deceleration in consumer spending growth could signal weakening domestic demand and influence BoE policy stance.

• German PPI YoY at 07:00 BST - Forecast: -1.8% vs Previous: -1.5% - Deeper producer price deflation may indicate persistent disinflationary pressures across the eurozone, affecting ECB policy expectations.

• UK Retail Sales YoY at 07:00 BST - Forecast: 0.5% vs Previous: 1.1% - Continued slowdown in annual retail growth reinforces concerns about UK consumer resilience amid cost-of-living pressures.

• French Business Confidence at 07:45 BST - Forecast: 95.0 vs Previous: 96.0 - Declining corporate sentiment in Europe's second-largest economy could weigh on euro and broader European equity markets.

• Canadian Retail Sales MoM Final at 13:30 BST - Forecast: -0.6% vs Previous: 1.5% - Sharp reversal in Canadian consumer spending may pressure the CAD and signal cooling domestic demand ahead of BoC decisions.

• Iperionx Ltd. (IPX) at 13:00 GMT [Pre-Market] - Est: $-0.00 vs Prev: $-0.01 - Titanium technology company's earnings could signal momentum in critical minerals sector amid supply chain diversification trends.

• Top Glove Corporation Bhd. (TOPGLOV) at 13:00 GMT [Pre-Market] - Est: $0.00 vs Prev: $0.00 - World's largest glove manufacturer's results may indicate post-pandemic demand normalization in healthcare supplies sector.

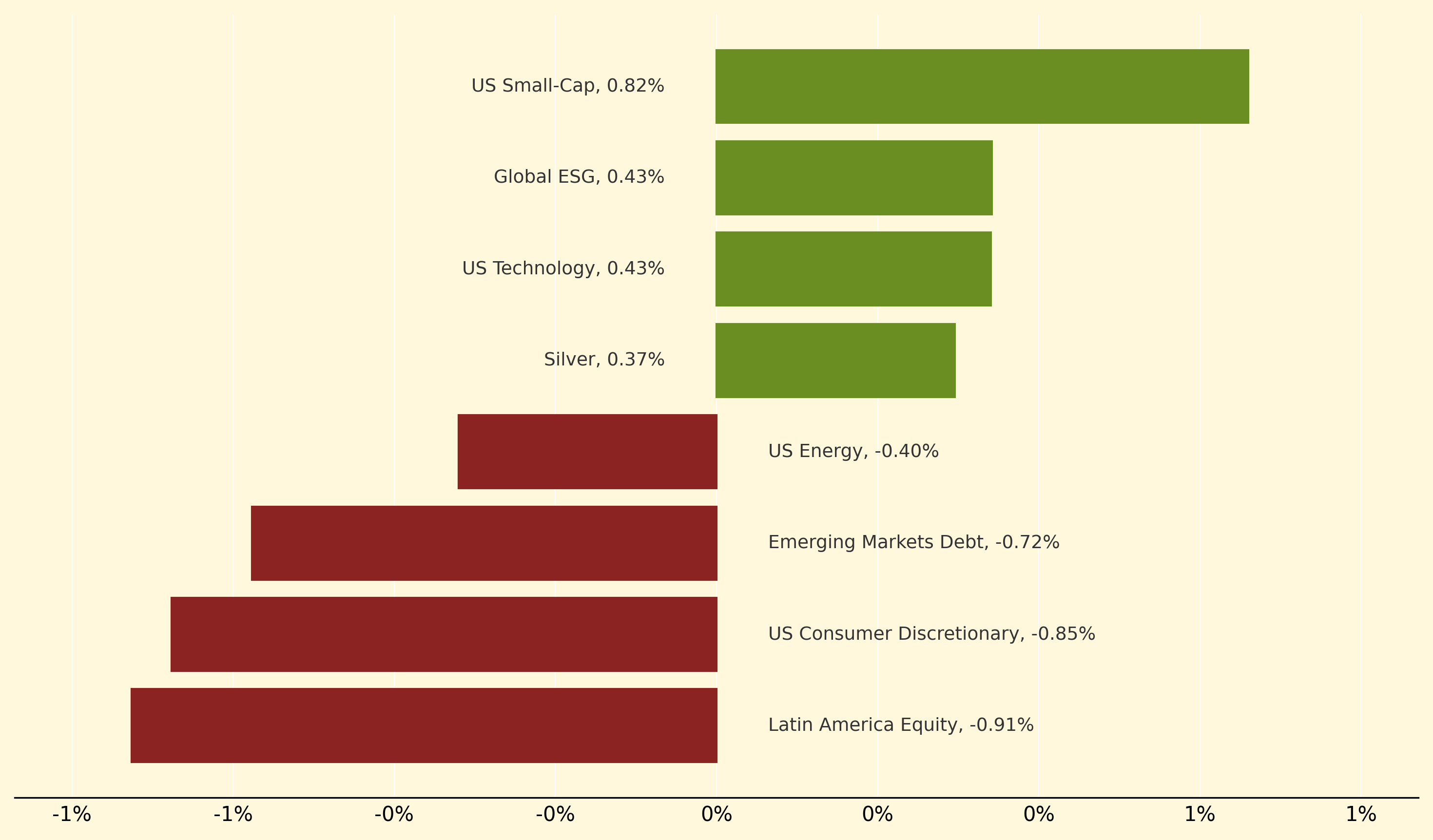

US Small-Cap strategies dominated yesterday's trading, surging 0.82% as investors positioned for potential domestic policy benefits following the Fed's dovish pivot. Global ESG and US Technology both advanced 0.43%, with the latter benefiting from Nvidia's historic $5 billion Intel investment that reshaped semiconductor sector dynamics and drove broader tech optimism.

Latin America Equity faced the steepest decline at -0.91%, pressured by China's strategic pivot away from US agricultural imports and broader emerging market concerns ahead of the Trump-Xi call. US Consumer Discretionary fell 0.85% as economic uncertainty weighed on spending expectations, while Emerging Markets Debt dropped 0.72% amid central bank policy divergence creating volatile cross-currency flows that challenged traditional fixed income positioning.

Quantitative tightening: Central bank policy of actively reducing balance sheet size by allowing government bonds to mature without replacement, alongside potential outright sales, creating additional upward pressure on yields beyond traditional rate rises.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry