Fed Policy Split Emerges as Officials Signal Caution on Further Rate Cuts | Links: [1], [2], [3], [4]

Federal Reserve officials are sending starkly different signals about monetary policy, creating uncertainty just as markets have priced in a 90% probability of October cuts. Fed Governor Miran, a Trump appointee, advocates for rates around "mid-2%" and warns current policy risks higher unemployment. However, other officials including Hammack and Musalem are pushing back hard, arguing inflation remains too elevated for aggressive easing. The effective fed funds rate is already edging higher within its target range as funding costs rise and foreign banks reduce cash holdings. This division takes on heightened importance with Powell's upcoming speech, particularly as potential government shutdown risks could disrupt critical economic data releases, potentially leaving the Fed operating with incomplete information on future decisions.

Nvidia Commits Up to $100 Billion to OpenAI in Transformative AI Infrastructure Deal | Links: [5], [6], [7], [8]

Nvidia has announced plans to invest up to $100 billion in OpenAI as part of a massive data centre buildout, potentially generating $500 billion in revenue implications and linking the two most influential companies in artificial intelligence. Analysts express mixed reactions to what some call a "circular" investment structure, where Nvidia essentially invests in OpenAI to purchase back its own chips. The partnership raises significant antitrust concerns about market concentration, with competitive implications for rivals like AMD and questions about preferential treatment despite Nvidia's assurances that all customers will remain "priority." Industry experts worry about strategic lock-in effects between Nvidia's hardware dominance and OpenAI's software leadership. The "staggering commitment" represents one of the largest technology partnerships in the AI boom, potentially cementing both companies' positions whilst inviting regulatory scrutiny.

China Floods Global Markets with Cheap Exports Following Trump Tariffs | Links: [9], [10], [11]

China has responded to Trump's tariffs by dramatically increasing exports to third-country markets, creating significant global trade rebalancing with deflationary pressures worldwide. Rather than reducing Chinese competitiveness, the tariff strategy has prompted manufacturers to redirect record amounts of cheap goods into alternative markets, forcing other economies to consider defensive trade measures. European consumers are already responding by cutting spending and avoiding US goods, according to ECB surveys, whilst companies globally reassess supply chain strategies. The development demonstrates how unilateral trade actions can have unintended consequences, pushing Chinese production capacity into new markets rather than reducing overall export volumes. This creates complex dynamics where Trump's tariffs may reduce bilateral US-China trade but increase price pressures elsewhere, potentially undermining the global fight against inflation.

US Offers Major Financial Support to Argentina as Emerging Market Outreach Expands | Links: [12]

The US Treasury pledged "large and forceful" support for Argentina, including potential currency interventions and debt purchases, sparking a 14% surge in Argentine stocks and 4.7% peso gain. This represents a significant policy shift where the US is actively supporting emerging market stability through direct bilateral engagement rather than traditional IMF-led structures. The commitment indicates the administration views Latin American stability as strategically important, potentially as a counterweight to Chinese influence in the region. Markets are interpreting this as a signal that the US may provide similar support to other strategically important emerging economies, creating a new paradigm for developing nation financial stability. The move contrasts sharply with previous approaches focused primarily on trade restrictions, indicating economic diplomacy as a preferred tool for regional influence.

US Equity Concentration Risks Reach Extreme Levels as Valuations Hit 95th Percentile | Links: [13], [14]

US equity markets are exhibiting unprecedented concentration risks as institutional allocations reach extreme levels, with DC pension plans holding 70% equity weights and households directing 45.4% of financial assets to stocks. Analysis shows US stock outperformance versus bonds has reached the 93rd-95th percentiles on rolling 3-5 year periods, with valuations described as "unambiguously elevated." This concentration comes as the 40-year bond bull market has ended, forcing investors to reconsider traditional portfolio construction models that relied on stock-bond diversification. Wall Street indices continue posting record highs driven by technology giants, but analysts warn sustainability depends heavily on continued earnings growth from a narrow group of mega-cap companies. The structural shift indicates traditional diversification benefits may be compromised, requiring new approaches to portfolio risk management as previous episodes of extreme equity concentration have preceded major corrections.

| Dow Jones Industrial Average | --▲ +0.38% |

| S&P 500 | --▲ +0.59% |

| Hang Seng Index | --▼ -0.44% |

| FTSE 100 | --▲ +0.11% |

| CAC 40 | --▼ -0.22% |

| DAX 40 | --▼ -0.17% |

| Euro Stoxx 50 | --▼ -0.38% |

| Nasdaq Composite | --▲ +0.81% |

| Nasdaq-100 | --▲ +0.70% |

| Nikkei 225 | --▲ +0.66% |

| S&P/ASX 200 | --▲ +0.43% |

| Shanghai Composite | --▲ +0.17% |

| S&P 500 E-mini | 6747.75-4.75▼ -0.07% |

| Nasdaq-100 | 24987.50-15.50▼ -0.06% |

| FTSE 100 Index | 9293.00+9.50▲ +0.10% |

| EURO STOXX 50 | 5458.00+4.00▲ +0.07% |

| WTI Crude Oil | 61.99-0.29▼ -0.47% |

| Gold (COMEX) | 3781.40+6.30▲ +0.17% |

| Copper (COMEX) | 4.63+0.00▼ -0.05% |

| US 10-Year Treasury | 112.70+0.00▲ +0.00% |

| UK Long Gilt (10Y) | 117.76+0.00▲ +0.00% |

| German Bund (10Y) | 128.26+0.00▲ +0.00% |

| Italian BTP (10Y) | 119.80+0.07▲ +0.06% |

| US Dollar Index | 96.99+0.04▲ +0.04% |

| VIX Volatility | 18.10+0.05▲ +0.29% |

| SONIA 3M Interest Rate | 96.14+0.01▲ +0.01% |

• German HCOB Manufacturing PMI Flash at 08:30 BST - Forecast: 50.1 vs Previous: 49.8 - Key gauge of eurozone's largest economy potentially returning to expansion territory, critical for ECB policy outlook and euro strength.

• UK S&P Global Manufacturing PMI Flash at 09:30 BST - Forecast: 47.2 vs Previous: 47.0 - Manufacturing sector remains deeply contracted, reinforcing concerns about UK industrial competitiveness and BoE dovish stance.

• UK S&P Global Services PMI Flash at 09:30 BST - Forecast: 53.6 vs Previous: 54.2 - Services sector slowdown could signal broader UK economic momentum loss, impacting sterling and gilt yields.

• US Fed Chair Powell Speech at 17:35 BST - Key insights into Fed's December rate cut expectations and 2025 policy trajectory following recent hawkish shift in dot plot projections.

• French HCOB Services PMI Flash at 08:15 BST - Forecast: 49.7 vs Previous: 49.8 - France's dominant services sector struggling below 50, adding to eurozone growth concerns and ECB easing case.

• EU HCOB Composite PMI Flash at 09:00 BST - Forecast: 51.1 vs Previous: 51.0 - Marginal eurozone expansion reading crucial for assessing regional recovery momentum and ECB December policy stance.

• Kingfisher Plc (KGF) at 07:00 BST [Pre-Market] - Est: $0.17 vs Prev: $0.09 - Europe's largest home improvement retailer's results will signal consumer discretionary spending trends amid UK housing market pressures.

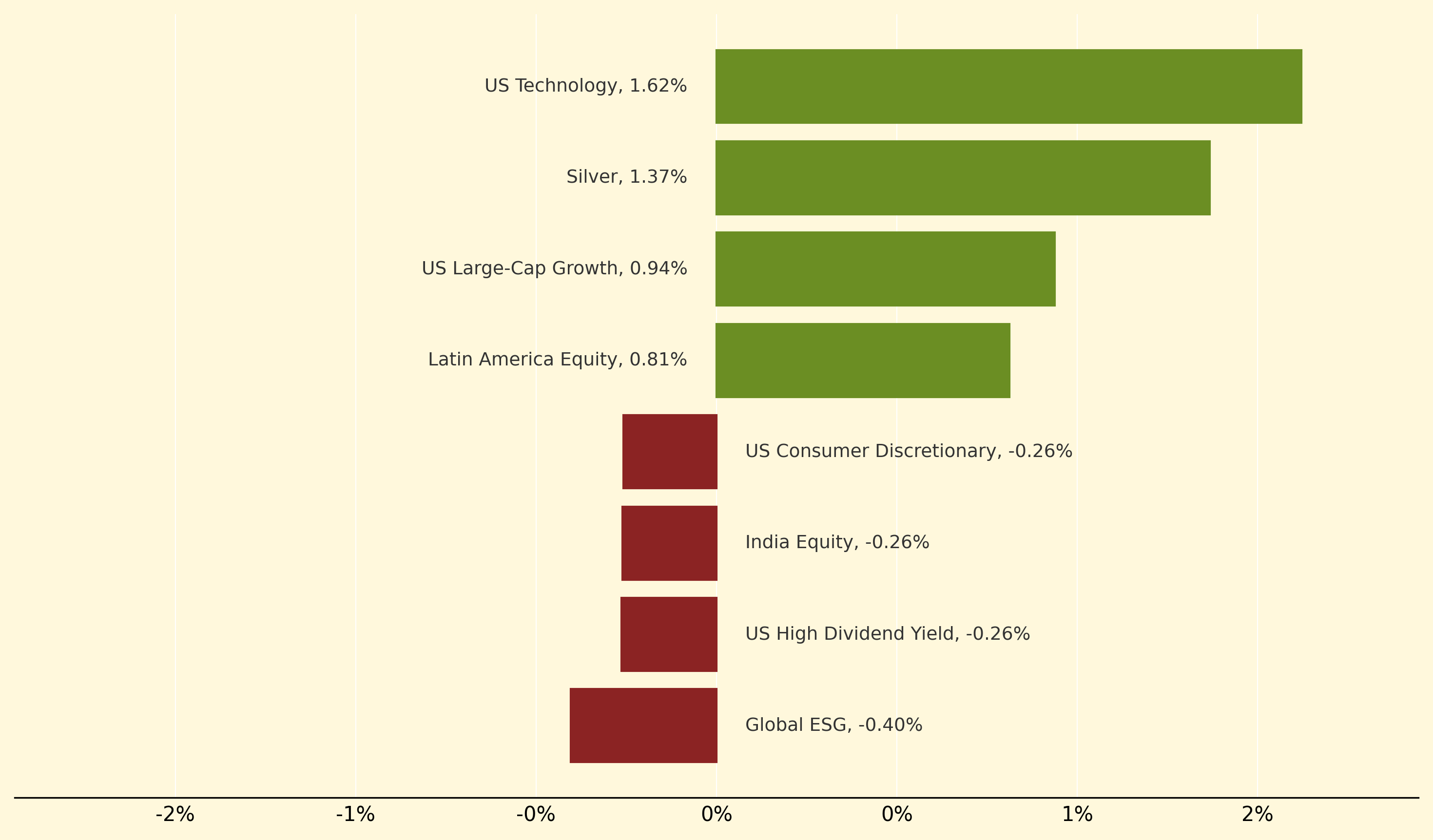

US Technology led gains, climbing 1.62% as the substantial Nvidia-OpenAI partnership sparked renewed AI optimism across the sector. Silver also performed strongly, advancing 1.37% amid rate cut speculation and record gold prices, whilst US Large-Cap Growth gained 0.94% benefiting from the tech rally and Fed policy uncertainty.

Conversely, Global ESG strategies underperformed, dropping 0.40% as investors rotated toward growth themes over sustainability mandates. US High Dividend Yield also lagged, falling 0.26% alongside India Equity and US Consumer Discretionary, reflecting broader concerns about defensive positioning amid mixed Fed signals and Trump's new $100,000 H-1B visa fees dampening sentiment toward dividend-focused and international strategies.

Trade rebalancing: The strategic redirection of export flows and supply chains following trade policy changes, where restricted bilateral trade routes prompt producers to flood alternative markets, creating new competitive pressures and potentially undermining the original policy objectives through unintended global market disruptions.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry