Global Risk-Off Accelerates as Banking Stress Meets Trade War Fears | Links: [1], [2], [3]

Markets are experiencing their sharpest risk-off rotation in months as US regional banking pressure meets intensifying US-China trade tensions. Gold surged beyond $4,300/oz for its strongest week in 17 years while Treasury five-year yields plummeted to October 2024 lows, reflecting acute concerns about financial stability and geopolitical risks. The yen strengthened past 150 per dollar for the first time since early October as investors sought traditional safe havens. This dual shock has triggered massive flows out of risk assets, with Asian markets falling sharply overnight and copper declining on credit and trade worries. The convergence suggests markets are pricing in fundamental structural risks rather than temporary volatility.

US Regional Banking Crisis Signals Broader Financial System Stress | Links: [4], [5], [6]

US regional banks face their most challenging environment since the 2023 sector crisis, with Zions Bancorp shocking markets with $50mn in unexpected California loan losses. The broader sector confronts mounting concerns around commercial real estate exposure and credit quality deterioration, while banks tapped $15bn from the Fed's standing repo facility, indicating acute short-term liquidity pressures. Perhaps most concerning, Fed staff have identified a staggering $1.4 trillion in unreported hedge fund Treasury holdings, highlighting massive transparency gaps in fixed income markets. This combination of visible pressure and hidden leverage exposure has triggered significant outflows from regional bank stocks and sparked fears about systemic credit risks spreading beyond the banking sector. The developments suggest the financial system may be more fragile than widely assumed.

ECB Signals Policy Stability Amid European Political Gains | Links: [7], [8], [9]

European markets provided a stark contrast to US pressure, with French stocks jumping to seven-month highs after the government survived a confidence vote and ECB officials signalling policy is in a "good place". Multiple ECB Governing Council members, including Lane, Dolenc, and Kocher, expressed confidence that current rates are appropriately positioned, suggesting the easing cycle may be complete. This hawkish tilt comes as European inflation shows persistence and officials emphasise data-dependent decisions rather than predetermined cuts. Meanwhile, Italy announced plans to extract €12.8bn from banks and insurers over three years to fund its 2026-2028 budget, representing a permanent fiscal adjustment. The policy divergence from Fed expectations could strengthen EUR positioning even as European banks face dual pressures from Italian fiscal extractions and potential ECB hawkishness.

AI Sector Shows Resilience Despite Correction Warnings | Links: [10], [11]

The AI sector demonstrated remarkable resilience with TSMC reporting record 39% profit growth driven by unprecedented AI chip demand, while Salesforce's ambitious $60bn revenue forecast significantly eased concerns about enterprise software disruption from generative AI. TSMC's results highlight the sustained infrastructure investment cycle supporting semiconductor demand, contrasting sharply with recent tech sector volatility and suggesting AI infrastructure companies may be better insulated from broader market corrections. However, former Meta executive Nick Clegg cautioned that the probability of an AI market correction remains "pretty high" due to elevated valuations. The earnings suggest the AI infrastructure investment thesis remains intact despite valuation concerns, with enterprise software integration potentially supporting traditional tech companies rather than displacing them.

Geopolitical Chess Moves Reshape Global Risk Assessment | Links: [12], [13], [14]

Geopolitical tensions are reaching inflection points across multiple fronts, forcing asset managers to recalibrate risk frameworks entirely. Trump's planned meeting with Putin in Budapest to discuss Ukraine represents a potential major shift in European security dynamics, with oil markets already declining on speculation about conflict resolution. The Netherlands seized control of Chinese-owned Nexperia, escalating Europe's semiconductor sovereignty efforts and highlighting supply chain vulnerabilities in critical technologies. Meanwhile, the Swiss court ruling on Credit Suisse's $17bn AT1 bond saga has created unprecedented uncertainty over contingent convertible bonds globally, potentially reshaping bank capital structures. These developments underscore how geopolitical risks are increasingly driving market structure changes across energy security, technology sovereignty, and financial regulation—requiring active reassessment of portfolio positioning beyond traditional asset class boundaries.

| S&P 500 | 6629.07-59.95▼ -0.90% |

| FTSE 100 | 9436.10+11.30▲ +0.12% |

| CAC 40 | 8188.59+95.13▲ +1.18% |

| DAX 40 | 24272.20+84.00▲ +0.35% |

| Dow Jones | 45952.20-336.90▼ -0.73% |

| Euro Stoxx 50 | 5652.01+47.67▲ +0.85% |

| Hang Seng | 25888.50-1.50▼ -0.01% |

| Nasdaq 100 | 24657.20-225.00▼ -0.90% |

| Nasdaq Comp | 22562.50-201.90▼ -0.89% |

| Nikkei 225 | 48277.70+170.30▲ +0.35% |

| S&P/ASX 200 | 9068.40+77.50▲ +0.86% |

| Shanghai Comp | 3916.23+15.55▲ +0.40% |

| S&P 500 E-mini | 6626.75-42.00▼ -0.63% |

| Nasdaq 100 | 24660.00-171.25▼ -0.69% |

| FTSE 100 | 9373.00-98.00▼ -1.03% |

| Euro Stoxx 50 | 5602.00-57.00▼ -1.01% |

| WTI Crude | 56.85-0.14▼ -0.25% |

| Gold | 4374.40+69.80▲ +1.62% |

| Copper | 4.95-0.05▼ -0.98% |

| US 10Y Treasury | 113.97+0.22▲ +0.19% |

| UK 10Y Gilt | 118.94+0.31▲ +0.26% |

| German 10Y Bund | 130.55+0.55▲ +0.42% |

| Italian 10Y BTP | 121.63+0.06▲ +0.05% |

| US Dollar Index | 97.92-0.22▼ -0.22% |

| VIX Volatility | 22.85+0.43▲ +1.94% |

| SONIA 3M | 96.19+0.01▲ +0.01% |

• Japanese BoJ Uchida Speech at 07:35 BST - Central bank communication that could signal shifts in Japan's monetary policy stance and impact yen volatility.

• UK BoE Pill Speech at 10:35 BST - Deputy Governor's remarks may provide insights into the Bank's interest rate outlook and inflation strategy.

• US Export Prices MoM at 13:30 BST - Previous: 0.3% - Trade price data that feeds into inflation expectations and could influence Federal Reserve policy decisions.

• US Import Prices MoM at 13:30 BST - Previous: 0.3% - Key inflation indicator that affects consumer price pressures and Fed monetary policy considerations.

• US Industrial Production MoM at 14:15 BST - Forecast: 0.1% vs Previous: 0.1% - Manufacturing activity gauge that signals economic momentum and potential impact on employment trends.

• US Fed Musalem Speech at 17:15 BST - Federal Reserve official commentary that could provide clues on future interest rate direction and monetary policy stance.

• Volvo AB Class A (VOLV_A) at 06:20 BST [Pre-Market] - Est: $0.43 vs Prev: $0.38 - European automotive sector faces scrutiny as truck demand and EV transition costs weigh on industrial sentiment.

• American Express Company (AXP) at 12:00 BST [Pre-Market] - Est: $4.00 vs Prev: $4.08 - Premium credit card spending patterns and loan loss provisions could signal broader consumer health trends across financial markets.

• SLB Limited (SLB) at 12:00 BST [Pre-Market] - Est: $0.68 vs Prev: $0.74 - Oilfield services performance may indicate energy sector capex trends and global drilling activity momentum.

• State Street Corporation (STT) at 12:30 BST [Pre-Market] - Est: $2.64 vs Prev: $2.53 - Custody banking results could reflect institutional asset flows and fee income pressures across financial services.

• Reliance Industries Limited (RELIANCE) at 13:00 BST [Pre-Market] - Est: $0.16 vs Prev: $0.19 - India's largest conglomerate earnings may influence emerging market sentiment and petrochemicals outlook.

• Truist Financial Corporation (TFC) at 14:30 BST [During-Hours] - Est: $0.99 vs Prev: $0.90 - Regional banking performance could impact sector sentiment amid ongoing net interest margin and credit quality concerns.

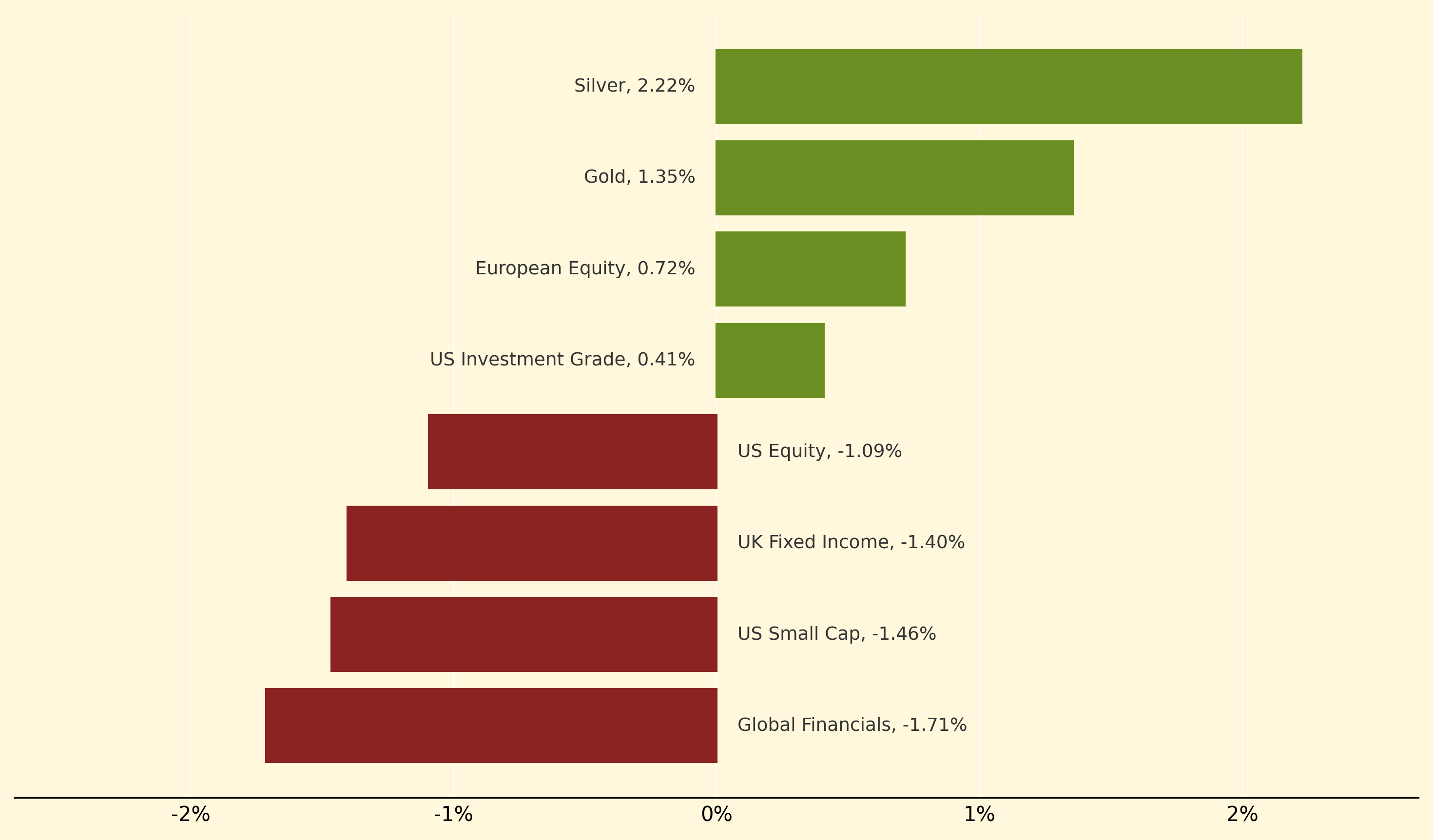

Silver and gold dominated safe-haven flows, surging 2.22% and 1.35% respectively as banking pressure and US-China trade tensions triggered the most acute risk-off rotation in months. European Equity also gained 0.72%, benefiting from the ECB's hawkish policy signals and French political stability after the government survived a confidence vote.

Global Financials bore the brunt of credit concerns, plummeting 1.71% following Zions Bancorp's shocking $50mn California loan losses and broader regional banking pressure. US Small Cap fell 1.46% while US Large-Cap declined 0.93%, reflecting widespread flight from risk assets as investors grappled with the $1.4 trillion in unreported hedge fund Treasury holdings and acute short-term liquidity pressures across the financial system.

Standing repo facility: A Federal Reserve lending mechanism that provides overnight liquidity to financial institutions against Treasury collateral, with usage spikes indicating acute short-term funding stress across the banking system and potential broader financial stability concerns.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry