US-China Trade Tensions Escalate as Global Finance Chiefs Voice Alarm | Links: [1], [2], [3]

The world's two largest economies lurched toward deeper confrontation as Treasury Secretary Bessent demanded the IMF and World Bank adopt tougher stances on China's economic practices, whilst Trump threatened "massive" tariffs on India until Russian oil imports cease and vowed to maintain 100% tariffs on China despite acknowledging they're "not sustainable." China responded with its own escalation, halting US soybean imports entirely in September for the first time in seven years. IMF and WTO chiefs warned of material damage to the global economy. The deterioration comes as Trump prepares for potential direct talks with Chinese leadership, creating a critical inflection point that could either defuse or dramatically worsen the standoff.

China's Economy Shows Deepest Weakness in a Year Despite Policy Support Signals | Links: [4], [5], [6]

China's Q3 GDP growth slowed to 4.8% year-on-year, the weakest pace in a year, as the property crisis deepened and trade tensions intensified. More concerning was fixed asset investment contracting 0.5% - a rare development that signals deeper structural problems in the world's second-largest economy. New home prices fell at their fastest pace in 11 months, underscoring the persistent real estate malaise. Despite this weakness, Chinese equity markets rose as investors anticipated policy support ahead of the upcoming Fourth Plenum meeting. Beijing kept lending rates unchanged for the fifth consecutive month, signalling monetary policy caution even as the data deteriorated. The disconnect between resilient industrial output and collapsing domestic investment highlights the challenge facing policymakers as they navigate between growth support and financial stability.

European Credit Stress Spreads as France Suffers Third Downgrade and Banking Fears Cross Atlantic | Links: [7], [8], [9]

European markets shuddered as credit concerns jumped the Atlantic, with private equity giants tumbling amid fears that US regional banking stress would spread to European lenders. France received its third sovereign credit downgrade in a year from S&P in an unscheduled move, citing budget risks that sent French bond futures lower. The broader European banking sector wobbled as investors grew increasingly uneasy about credit risks following recent write-downs and lending blow-ups across the region. ECB officials sent conflicting signals, with board member Wunsch suggesting further rate cuts are "increasingly unlikely" whilst Bundesbank's Nagel indicated eurozone inflation is "pretty much on target" for coming years.

EU Nations Close to Russian Gas Ban Agreement by 2027 | Links: [10]

European Union member states are nearing a landmark agreement to ban Russian gas imports by the end of 2027, marking a decisive shift in European energy security strategy three years after the Ukraine conflict began. The potential deal represents the culmination of Europe's energy independence efforts, with profound implications for alternative supply chains, infrastructure investment, and gas pricing dynamics across the continent. The move would complete Europe's systematic decoupling from Russian energy, forcing accelerated development of LNG terminals, renewable capacity, and alternative pipeline networks from Norway, Algeria, and the Middle East. European gas prices face structural adjustment as the continent prepares for this final break from Russian energy dependency, whilst Moscow's energy sector confronts further isolation from its largest historical market. The agreement underscores Europe's commitment to energy sovereignty despite the significant costs and logistical challenges of replacing Russian supplies.

Japan's Political Shift Sets Stage for Monetary Policy Divergence in 2025 | Links: [11], [12], [13]

Japan approached a historic political transition as conservative Sanae Takaichi appeared set to become the country's first female Prime Minister through a coalition deal, her dovish monetary policy stance contrasting sharply with BOJ board member Takata's continued calls for rate hikes to 0.75%. The Nikkei surged on coalition hopes and pro-stimulus expectations, whilst the yen weakened on dovish leadership prospects that could delay the Bank of Japan's normalisation plans. BOJ Governor Ueda kept his cards close ahead of the October 29-30 meeting, but institutional investors are positioning for policy uncertainty - Vanguard notably betting on eventual rate hikes and yield curve flattening. Japan's policy direction will significantly impact global carry trades, Asia-Pacific risk sentiment, and the broader divergence in G7 monetary policies as central banks chart different courses through 2025's increasingly complex economic landscape.

| S&P 500 | 6664.01+50.74▲ +0.77% |

| FTSE 100 | 9354.60-81.50▼ -0.86% |

| CAC 40 | 8174.20+81.67▲ +1.01% |

| DAX 40 | 23831.00-2.10▼ -0.01% |

| Dow Jones | 46190.60+328.20▲ +0.72% |

| Euro Stoxx 50 | 5607.39-11.09▼ -0.20% |

| Hang Seng | 25247.10-604.80▼ -2.34% |

| Nasdaq 100 | 24817.90+217.30▲ +0.88% |

| Nasdaq Comp | 22680.00+190.20▲ +0.85% |

| Nikkei 225 | 47582.10-238.90▼ -0.50% |

| S&P/ASX 200 | 8995.30-73.10▼ -0.81% |

| Shanghai Comp | 3839.75-72.29▼ -1.85% |

| S&P 500 E-mini | 6724.75+22.25▲ +0.33% |

| Nasdaq 100 | 25098.20+111.75▲ +0.45% |

| FTSE 100 | 9421.50+31.50▲ +0.34% |

| Euro Stoxx 50 | 5661.00+43.00▲ +0.77% |

| WTI Crude | 56.92-0.23▼ -0.40% |

| Gold | 4270.20+56.90▲ +1.35% |

| Copper | 5.04+0.07▲ +1.46% |

| US 10Y Treasury | 113.38-0.09▼ -0.08% |

| UK 10Y Gilt | 118.56-0.07▼ -0.06% |

| German 10Y Bund | 129.86-0.11▼ -0.08% |

| Italian 10Y BTP | 121.46-0.17▼ -0.14% |

| US Dollar Index | 98.19+0.00▲ +0.00% |

| VIX Volatility | 20.40-0.31▼ -1.49% |

| SONIA 3M | 96.18+0.00▼ -0.01% |

• Canadian Inflation Rate YoY on Tuesday at 13:30 GMT - Previous: 1.9% - Key gauge for Bank of Canada policy direction and CAD strength.

• Japanese Balance of Trade on Wednesday at 00:50 GMT - Previous: ¥-242.5B - Critical for yen direction and export sector performance.

• UK Inflation Rate YoY on Wednesday at 07:00 GMT - Forecast: 4.0% vs Previous: 3.8% - Major driver for Bank of England rate decisions and GBP volatility.

• Japanese Inflation Rate YoY on Friday at 00:30 GMT - Previous: 2.7% - Influences BoJ policy stance and yen positioning ahead of potential intervention.

• UK Retail Sales MoM on Friday at 07:00 GMT - Forecast: -0.2% vs Previous: 0.5% - Key consumer spending indicator affecting GBP and retail sector outlook.

• German Manufacturing PMI Flash on Friday at 08:30 GMT - Forecast: 49.6 vs Previous: 49.5 - Critical gauge of eurozone's largest economy and EUR direction.

• UK Manufacturing PMI Flash on Friday at 09:30 GMT - Previous: 46.2 - Essential indicator of UK industrial health and potential recession signals.

• UK Services PMI Flash on Friday at 09:30 GMT - Previous: 50.8 - Dominant sector reading crucial for UK growth outlook and monetary policy.

• US Core Inflation Rate YoY on Friday at 13:30 GMT - Forecast: 3.1% vs Previous: 3.1% - Fed's preferred inflation measure driving rate cut expectations and USD moves.

• US Inflation Rate MoM on Friday at 13:30 GMT - Forecast: 0.4% vs Previous: 0.4% - Monthly price pressure reading influencing Fed policy timeline and bond yields.

• UniCredit S.p.A. (UCG) on Tuesday at 06:00 BST Pre-Market - $111.8B - Major European banking earnings kicking off the week, providing insights into eurozone lending conditions and financial sector health.

• Coca-Cola Company (KO) on Tuesday at 11:55 BST Pre-Market - $294.5B - Consumer staples bellwether offering visibility into global consumer spending patterns and emerging market demand trends.

• GE Aerospace (GE) on Tuesday at 14:30 BST During-Hours - $318.3B - Aerospace giant's results will indicate commercial aviation recovery strength and defense spending momentum.

• Netflix (NFLX) on Tuesday at 21:01 BST During-Hours - $509.6B - Streaming leader's subscriber growth and guidance crucial for tech sector sentiment and media industry outlook.

• Tesla (TSLA) on Wednesday at 21:00 BST During-Hours - $1.5T - EV pioneer's delivery numbers and autonomous driving progress will drive broader automotive and tech sector moves.

• SAP (SAP) on Wednesday at 21:05 BST During-Hours - $314.0B - European software leader's cloud transition progress and enterprise spending trends key for tech sector direction.

• IBM (IBM) on Wednesday at 21:08 BST During-Hours - $262.0B - Legacy tech transformation story with AI and hybrid cloud growth metrics watched closely by institutional investors.

• T-Mobile US (TMUS) on Thursday at 12:00 BST Pre-Market - $258.1B - Telecom sector leader's 5G rollout progress and subscriber trends indicating infrastructure investment success.

• Intel (INTC) on Thursday at 21:01 BST During-Hours - $172.8B - Semiconductor giant's turnaround progress and foundry business development critical for chip sector sentiment.

• Procter & Gamble (PG) on Friday at 14:30 BST During-Hours - $354.3B - Consumer goods heavyweight closing the week with insights into pricing power and global consumer resilience.

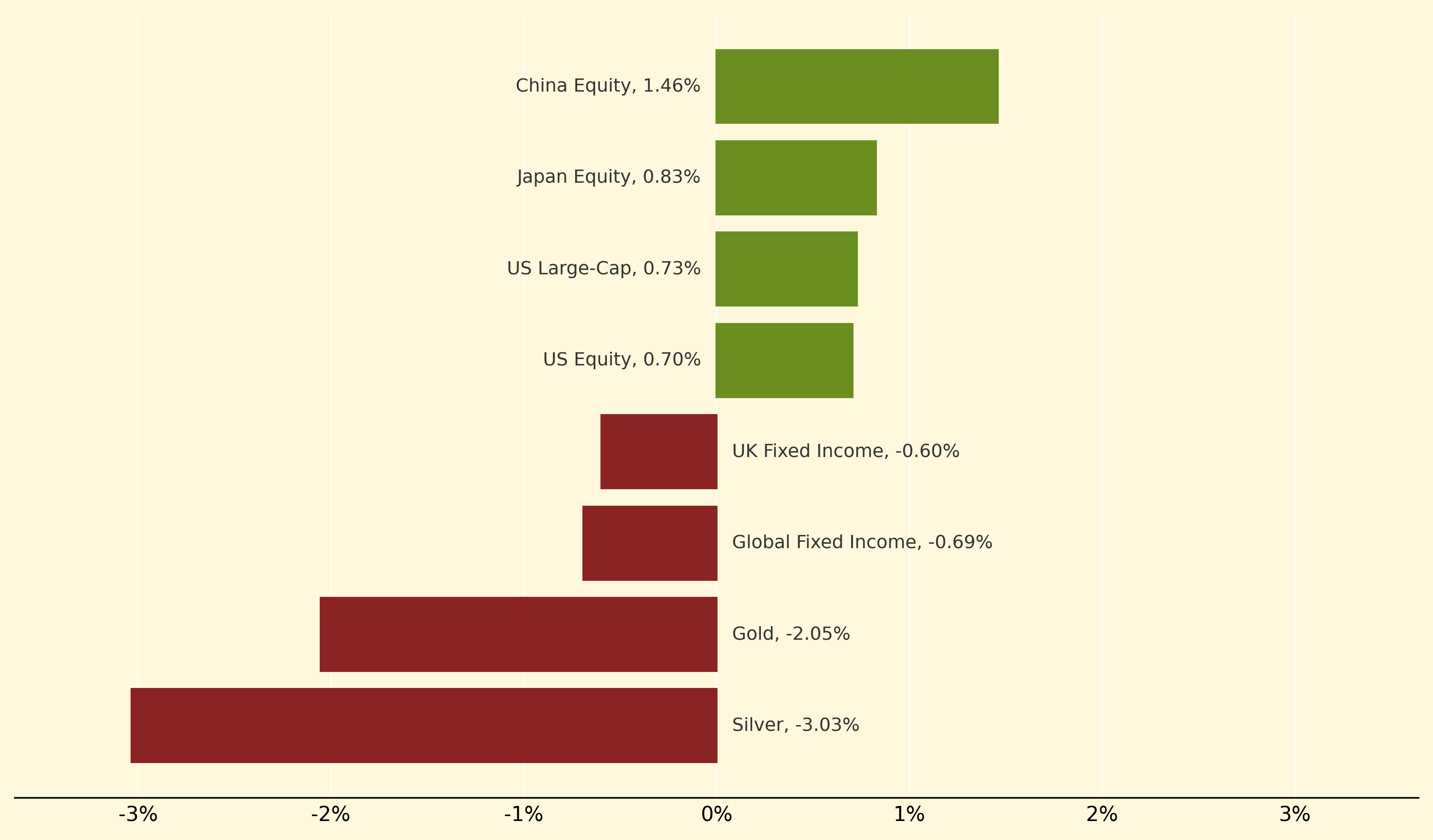

China Equity led yesterday's gains, climbing 1.46% as investors looked past weak Q3 GDP data and positioned for policy support ahead of the Fourth Plenum meeting. Japan Equity also performed well, advancing 0.83% on coalition hopes that could install Takaichi as the country's first female Prime Minister, whilst US Large-Cap and US Equity both gained around 0.7% as markets digested Trump's softer trade rhetoric.

Conversely, precious metals suffered sharp declines with Silver plummeting 3.03% and Gold dropping 2.05% as the dollar strengthened following Trump's comments that high China tariffs are "not sustainable." Fixed income strategies also lagged, with Global Fixed Income falling 0.69% and UK Fixed Income down 0.6% as credit concerns spread from US banking jitters to European markets, prompting a flight from bonds despite ongoing monetary policy uncertainty.

Fixed asset investment: The total expenditure by businesses and government on physical assets like factories, machinery, and infrastructure. When this metric contracts, as happened in China with a -0.5% decline, it signals deep structural economic problems since it reflects companies' reluctance to invest in future productive capacity, indicating weak confidence in long-term growth prospects.

Thanks for reading Morning Fill. Have a great day!

Ollie and Harry